How to Buy Off the Plan: A Step-by-Step Guide for Buyers

At Ello Lending, we specialize in helping borrowers finance their dream properties and understand that purchasing a property is a significant life event. We know this is a big deal for you and we want you know we take your trust seriously.

In this comprehensive guide to buying property off the plan, we'll walk you through the entire process to ensure you are well-informed and confident in making your off-the-plan property purchase. We'll discuss the following:

- What is "off the plan" property? "Off the plan" refers to purchasing a property before it is fully constructed. This means you'll be buying based on the developer's plans and artist impressions, rather than inspecting a completed property. Off-the-plan purchases are common for new apartments, townhouses, and house-and-land packages. This guide will help you navigate the unique aspects of off-the-plan purchases and equip you with the knowledge to make well-informed decisions.

- Benefits of buying off the plan There are several advantages to purchasing property off the plan. You may secure a property at a lower price than if you were buying a completed property, as developers often offer incentives and discounts to attract early buyers. You'll also have the opportunity to customize your new home to suit your preferences and needs. Additionally, there can be potential capital growth during the construction period, which could result in increased property value by the time you take possession. Lastly, buying off the plan provides you with ample time to organize your finances and plan your move.

- Risks and considerations While there are benefits to off-the-plan purchases, it's essential to be aware of potential risks and challenges. Delays in construction, changes to the final product, or even the developer's insolvency can impact your investment. This guide will help you understand the risks involved and provide strategies for mitigating them.

We hope you find this guide informative and valuable as you embark on your off-the-plan property journey. Remember, the team at Ello Lending is always here to support you with friendly advice and professional assistance. Let's get started!

Researching The Market

Before diving into an off-the-plan property purchase, it's essential to conduct some research into the property market. Understanding the local market trends and identifying suitable locations will ensure you make a well-informed decision.

Don't just take for granted what you read or hear in the media as gospel. You want to be comfortable that you're making the right decision so take some time to really look into this.

In this section, we'll guide you through the key aspects of researching the property market and provide tips on how to maximize your investment.

- Identifying suitable locations: Location is a crucial factor when it comes to property investment. To find the ideal spot for your new home or investment property, consider factors such as proximity to amenities, public transport, schools, and employment opportunities. Researching the location's growth prospects, including planned infrastructure projects and population growth, can also help you gauge its potential for capital growth.

- Understanding local market trends: Staying informed about the local property market is vital to making a sound investment. This includes understanding current property prices, rental yields, and supply and demand dynamics in your desired area. Familiarize yourself with market trends, both short-term and long-term, to ensure you're making an informed decision. Keep an eye on property market reports and real estate news to stay updated on the latest developments.

- Investigating future infrastructure developments: Infrastructure plays a significant role in the value and appeal of a property. Investigating planned or proposed infrastructure projects, such as new roads, public transport, schools, and shopping centers, can give you an insight into the future potential of the area. Government and local council websites often provide information on upcoming infrastructure developments, which can be valuable when considering an off-the-plan property purchase.

By researching the market thoroughly, you'll not only be better equipped to make a wise investment decision that suits your needs and preferences, you'll be more comfortable with that decision long-term.

Think it through - it's worth it. Remember, the team at Ello Lending is here to support you every step of the way with expert advice and guidance.

Finding the Right Property

Realistically, you can't research the market without looking at actual off the plan properties. Chances are that in your pursuit of a better understanding of the ideal location and trends etc described above that you'll find the perfect off-the-plan property.

It's worth splitting these sections though, because choosing the right property is crucial, as it will have a significant impact on your lifestyle and investment potential. In this section, we'll cover essential aspects of finding the right property and provide tips to help you make the best decision.

- Sourcing reputable developers: When purchasing off the plan, it's crucial to work with a reputable developer with a proven track record of delivering quality projects on time. Research the developer's history, previous projects, and customer reviews to ensure they have a solid reputation. Don't hesitate to ask for references and speak to past clients to gain further insights into their experiences with the developer.

- Inspecting display suites and floor plans: While you won't be able to inspect a completed property, most developers will provide display suites or showrooms to give you a sense of the finished product. Visit these display suites to get a feel for the quality of the build, fixtures, and finishes. Carefully examine the floor plans to ensure the layout meets your needs and preferences. Keep in mind room dimensions, natural light, storage, and outdoor spaces when assessing the property.

- Comparing different projects: Before making a final decision, it's essential to compare various off-the-plan projects to determine which one best suits your needs and investment goals. Consider factors such as price, location, design, developer reputation, and potential rental yield. Create a shortlist of properties and weigh their pros and cons to make an informed decision.

Once again, it's really worth putting the effort into choosing the right property. Know what you won't compromise on, and try to strip out any emotion from the decision. Yeah this is hard, but marketers push scarcity tactics to get the sale - "This is the last lot!", "Early bird pricing ends tomorrow." Don't hate on them - they're running a business. But don't be rushed.

Again, we're experts in this space. If you've got questions then check out our blog posts here on the site. Otherwise, the team at Ello Lending is always here to help with any questions or concerns you may have during this exciting process.

Securing Finance

Once you've found the perfect off-the-plan property, the next step is to secure financing for your purchase. This process may seem daunting, but with the right guidance and support, it can be a smooth and stress-free experience. In this section, we'll discuss the essential aspects of securing finance for your off-the-plan property and how Ello Lending can help you every step of the way.

- Engaging Ello Lending as your mortgage broker: At Ello Lending, we specialize in helping borrowers finance their off-the-plan properties. By engaging us as your mortgage broker, you'll have access to our extensive knowledge and experience, as well as our strong relationships with a wide range of lenders. We'll work closely with you to understand your financial needs and goals, ensuring you secure the most suitable loan product for your circumstances.

- Determining your borrowing capacity: Understanding how much you can borrow is a crucial first step in the financing process. Your borrowing capacity is influenced by factors such as your income, expenses, existing debts, and credit history. At Ello Lending, we'll help you assess your financial situation and provide a clear understanding of your borrowing capacity, which will guide you in making informed decisions about your off-the-plan property purchase.

- Pre-approval process: Obtaining pre-approval for a home loan is an essential step in the off-the-plan property buying process. Pre-approval provides you with a conditional approval from a lender, giving you confidence in your borrowing capacity and enabling you to move forward with your property purchase. We'll guide you through the pre-approval process, assisting you in gathering the required documentation and liaising with the lender on your behalf.

We're not just another mortgage broker. I mean, sure, we would say that, of course. But we really do live this stuff.

At Ello Lending love helping people and we are legit here to support you throughout the journey, ensuring you have the information and guidance necessary to make the best financial decisions.

Legal Matters: Don't Skip This

As you progress with your off-the-plan property purchase, you want peace of mind that this is going to be a smooth and hassle-free experience. Navigating the legal side of property buying can be complex, but with the right support and guidance, you'll be well-prepared to handle any challenges that may arise.

- Engaging a solicitor or conveyancer: To help you navigate the legal complexities of your off-the-plan purchase, it's crucial to engage the services of a solicitor or conveyancer. These professionals specialize in property law and will provide valuable advice and guidance throughout the process. They will review contracts, ensure compliance with relevant regulations, and handle the settlement process on your behalf, making the experience much smoother and stress-free.

- Reviewing the contract of sale: The contract of sale is a legally binding document that outlines the terms and conditions of your property purchase. Your solicitor or conveyancer will review this document to ensure it's fair and in your best interest. They will identify any potential issues, such as unclear clauses or hidden fees, and negotiate with the developer on your behalf if necessary. This step is crucial in protecting your rights as a buyer.

- Understanding the sunset clause: The sunset clause is a common feature in off-the-plan contracts, and it specifies a date by which the developer must complete the project. If the property is not completed by this date, you have the right to rescind the contract and recover your deposit. Your solicitor or conveyancer will help you understand the implications of the sunset clause and ensure it is reasonable and fair.

Address these matters up-front and you'll be well-equipped to handle any challenges that may arise during your off-the-plan property purchase. Things happen. And you want to be prepared if they do.

Government Grants and Incentives

When purchasing an off-the-plan property, it's essential to explore the various government grants and incentives available to home buyers in Australia.

These programs can significantly reduce the financial burden of buying a property.

In this section, we'll discuss the key government grants and incentives available, and provide resources to help you determine your eligibility and apply for these programs.

First Home Buyer's Grant

The First Home Owner Grant (FHOG) is a national scheme designed to assist first-time homebuyers in entering the property market. The grant amount and eligibility criteria vary between states and territories. Typically, it's a one-time payment that can be used toward the purchase of a new or substantially renovated home, including off-the-plan properties. To learn more about the FHOG and check your eligibility, visit the relevant government websites for your state or territory.

Stamp duty concessions

Stamp duty is a tax levied on property purchases and can be a significant expense for homebuyers. However, many states and territories offer stamp duty concessions or exemptions for first-time buyers and those purchasing off-the-plan properties. These concessions can result in substantial savings, making it more affordable to enter the property market. Visit your state or territory's revenue office website for more information on stamp duty concessions and eligibility criteria.

Other state-based incentives

In addition to the FHOG and stamp duty concessions, some states and territories offer additional incentives to encourage property investment and homeownership. These may include land tax rebates, reduced mortgage insurance, or discounts on new home builds. To explore the incentives available in your region, consult the relevant government websites and resources.

By taking advantage of these government grants and incentives, you can significantly reduce the financial burden of buying an off-the-plan property. Remember, the team at Ello Lending is here to support you throughout this process, providing guidance and advice to help you make the most of these programs. Happy savings!

List of Australian government grants and resources:

- First Home Owner Grant - National overview: https://www.firsthome.gov.au/

- State and territory revenue office websites:

- ACT: https://www.revenue.act.gov.au/

- NSW: https://www.revenue.nsw.gov.au/

- NT: https://nt.gov.au/property/home-owner-assistance

- QLD: https://www.qld.gov.au/housing/buying-owning-home

- SA: https://www.revenuesa.sa.gov.au/

- TAS: https://www.sro.tas.gov.au/

- VIC: https://www.sro.vic.gov.au/

- WA: https://www.wa.gov.au/organisation/department-of-finance

Reserving and Purchasing the Property

Once you've conducted thorough research, found the perfect off-the-plan property, and secured financing, it's time to reserve and purchase your new home. This crucial stage in the property buying process involves several key steps to ensure a smooth transaction and protect your interests as a buyer. In this section, we'll discuss the essential aspects of reserving and purchasing an off-the-plan property, providing guidance to help you navigate this exciting phase.

Placing a holding deposit: To reserve your chosen off-the-plan property, you'll typically need to place a holding deposit. This deposit secures the property while your solicitor or conveyancer reviews the contract of sale, and ensures the developer won't sell it to another buyer during this period. It's essential to understand the terms and conditions associated with the holding deposit, such as whether it's refundable if you decide not to proceed with the purchase.

Signing the contract of sale: Once you and your legal representative are satisfied with the terms of the contract of sale, you'll need to sign the document to formalize your commitment to purchasing the property. Ensure you understand all the terms and conditions outlined in the contract, including payment schedules, warranties, and your rights and obligations as a buyer. Your solicitor or conveyancer will be able to guide you through this process and address any concerns you may have.

Paying the deposit and exchanging contracts: After signing the contract of sale, you'll be required to pay a deposit, typically 5-10% of the property's purchase price. This deposit will be held in trust until settlement, at which point it will be applied toward the purchase price. Once the deposit is paid, the contracts will be exchanged between you and the developer, legally binding both parties to the terms of the agreement.

Note here: that the terms of sale as well as deposit requirements and details such as what happens if one party decides to withdraw from the agreement can vary massively from one developer to another and from one state to another.

It's highly recommended to get legal advice before signing anything at this point. If you've got questions and the team at Ello Lending is here to support you throughout the process. No, we're not lawyers and we're not offering legal advice - just to be crystal clear on that point! - we're specialized in off the plan and new house and land deals though and would be happy to offer some help navigating this part of the process!

Property Construction and Progress

After reserving and purchasing your off-the-plan property, the construction phase begins. It's essential to stay informed and engaged during this stage, as it ensures you're aware of any developments or potential delays that may impact your investment. In this section, we'll discuss the key aspects of property construction and progress, offering tips and guidance to help you stay informed and involved in your off-the-plan property's journey.

- Stay up-to-date with construction progress: To ensure a smooth and stress-free experience, it's important to stay up-to-date with the construction progress of your off-the-plan property. Regular communication with the developer or their representative will help you stay informed about the project's timeline, potential delays, and any changes to the original plans. This proactive approach will help you address any issues that may arise and make informed decisions about your investment.

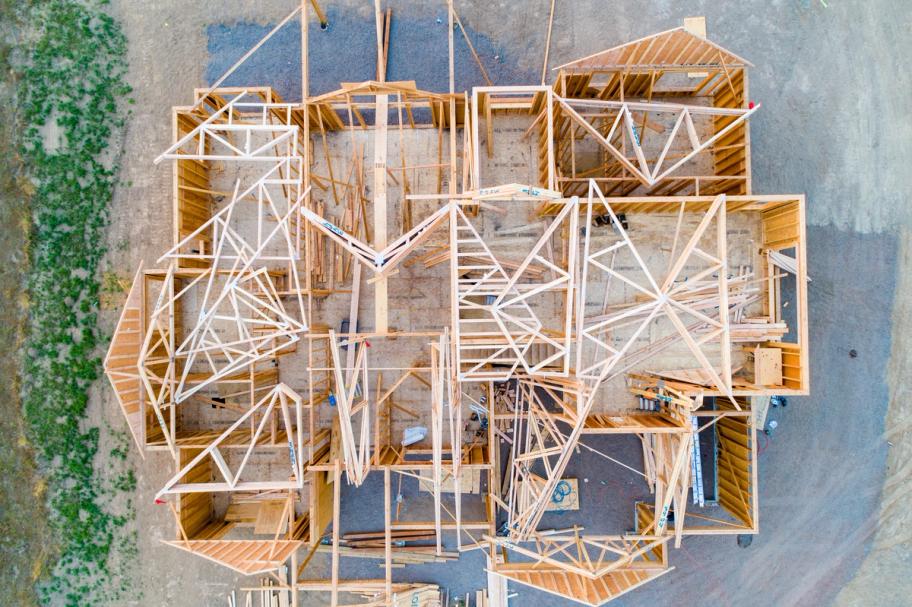

- Monitoring construction milestones: During the construction phase, there will be various milestones that indicate the progress of your off-the-plan property. These may include the completion of the foundation, framing, roofing, and final finishes. By keeping track of these milestones and their completion dates, you'll have a better understanding of the project's overall timeline and can plan accordingly for settlement and moving in.

- Address construction delays and variations: Construction delays and variations are common occurrences in off-the-plan property developments. These can result from factors such as weather conditions, labor shortages, or changes in materials. If delays or variations occur, it's crucial to understand your rights as a buyer and how they may impact the project's timeline and your financial commitments. Your solicitor or conveyancer can provide guidance on navigating these situations and ensuring your interests are protected.

Stay engaged and informed throughout the property construction and progress stage. This is super important and no one else can really do this for you.

As much as builders and tradies hate being hassled about progress, just remember that the squeakiest wheel gets the grease. You don't need to camp out next to the building site and become a nuisance but you do want to insist on transparency. A good builder will offer progress updates anyway.

If you have questions, let us know. Remember, the team at Ello Lending is always here to support you throughout this process, providing expert advice and guidance to help you make the best decisions for your investment.

Pre-settlement Inspection

As you approach the settlement of your off-the-plan property, conducting a pre-settlement inspection is an essential step in the process. This inspection ensures the property has been constructed according to the agreed-upon specifications and allows you to address any potential concerns before finalizing the purchase. In this section, we'll discuss the key aspects of pre-settlement inspection, providing guidance to help you effectively assess your new property and ensure a smooth settlement experience.

Scheduling the inspection: Timing is crucial when it comes to pre-settlement inspections. Ideally, you should schedule the inspection close to the settlement date, giving the developer enough time to address any issues that may arise while ensuring the property's condition remains consistent with the inspection findings. Coordinate with the developer or their representative to arrange a suitable inspection time that aligns with your schedule and the property's completion status.

Engaging a professional building inspector: While you may be tempted to conduct the pre-settlement inspection yourself, engaging a professional building inspector can provide valuable insights and expertise. A qualified building inspector will thoroughly assess the property, identify any defects or issues that may require attention, and provide an unbiased report on the property's condition. This expert assessment will help you make informed decisions about your off-the-plan property purchase and protect your interests as a buyer.

Addressing any concerns or defects: If the pre-settlement inspection reveals any concerns or defects, it's important to address them promptly and effectively. Work closely with your solicitor or conveyancer to ensure the developer is made aware of the issues and takes appropriate action to rectify them before settlement. By addressing these concerns, you'll ensure a smooth settlement process and have peace of mind knowing your new property meets your expectations.

By following these steps and conducting a thorough pre-settlement inspection, you'll be well-prepared to finalize your off-the-plan property purchase with confidence. The team at Ello Lending is here to support you throughout this process, providing expert advice and guidance to help you navigate any challenges that may arise. Let's ensure your new home is everything you've dreamed of and more!

Settlement & Moving In

Congratulations! You've reached the final stage of your off-the-plan property journey: settlement and moving in. As you prepare to take ownership of your new home, it's essential to stay organized and focused to ensure a smooth and enjoyable transition. In this section, we'll discuss the key aspects of settlement and moving in, offering tips and guidance to help you successfully complete your property purchase and start enjoying your new home.

Finalizing finances and paperwork

Before the settlement can occur, it's important to finalize your finances and ensure all necessary paperwork is in order. This includes obtaining formal loan approval, finalizing mortgage documents, and ensuring all conditions specified in the loan approval have been met.

At Ello Lending, we'll work closely with you throughout this process, liaising with the lender on your behalf and keeping you informed every step of the way.

Completing the settlement process

During the settlement process, your solicitor or conveyancer will handle the legal aspects of transferring ownership, such as lodging documents and paying any outstanding fees or taxes. They will also coordinate with the developer, lender, and other relevant parties to ensure a seamless and stress-free settlement.

By working with a trusted legal professional, you can have peace of mind knowing your interests are protected throughout this final stage.

Planning and executing your move

Once the settlement is complete, it's time to plan and execute your move into your new off-the-plan property. Begin by creating a moving checklist that outlines all the tasks you need to complete, such as hiring a removalist, packing, notifying utility providers, and updating your address with relevant organizations.

Allow ample time to complete these tasks, and consider enlisting the help of friends or family to make the process more efficient and enjoyable. With a well-organized plan in place, your transition to your new home will be smooth and stress-free.

By following these steps and preparing for settlement and moving in, you'll be well on your way to enjoying your new off-the-plan property.

How We Can Help

In all seriousness, the importance of having a trusted mortgage broker by your side can't be overstated.

At Ello Lending, we're passionate about helping our clients navigate the complexities of property financing and ensuring a seamless, stress-free experience from start to finish.

Using a trusted mortgage broker like us offers numerous benefits and advantages:

- Expert guidance: Our team of experienced mortgage brokers has in-depth knowledge of the Australian property market and the financing options available to you. We'll guide you through the entire process, providing tailored advice and recommendations to suit your unique circumstances and goals.

- Access to a wide range of loan products: We work with a vast network of lenders, giving you access to a wide range of loan products and competitive interest rates. Our goal is to find the best financing solution for your off-the-plan property purchase, ensuring you have the support and resources needed to make your dream home a reality.

- Personalized service: At Ello Lending, we're dedicated to providing personalized service that focuses on your needs and objectives. We'll work closely with you throughout the entire process, from researching the market and securing finance to addressing legal matters and preparing for settlement. Our commitment to your success is unwavering, and we'll be with you every step of the way.

- Saving you time and stress: Navigating the property market and securing finance can be a complex and time-consuming process. By partnering with Ello Lending, you can focus on the excitement of your off-the-plan property journey while we handle the details, saving you time and minimizing stress.

Our passion for helping clients achieve their property goals is at the heart of everything we do at Ello Lending. We understand the importance of having a trusted partner by your side throughout your off-the-plan property journey, and we're committed to providing the expert advice, resources, and support you need to make your dream home a reality.

If you're ready to begin your off-the-plan property journey or have any questions about the process, don't hesitate to contact us. Our friendly and knowledgeable team is here to help, and we look forward to helping make your property dreams come true.